The first few weeks of November 2021 have been (hopefully) consequential for the future of climate change. COP26 brought a flurry of pledges and commitments. More than $130 trillion in financial assets have been pledged to align with the Paris Agreement. Countries have agreed to phase out financing for coal-fired power plants and stop using tax dollars to fund international fossil fuel projects. Separately, the US passed the $1 trillion Infrastructure Investment and Jobs Act, which intends to improve the country’s resilience. But what happens now? Nations still haven’t achieved what was pledged in 2015; how can we ensure this time is different?

In the highly divided environment of today, implementation and deployment will be no easy task. Here are four steps to maximize the outcome and momentum from the recent marquee commitments.

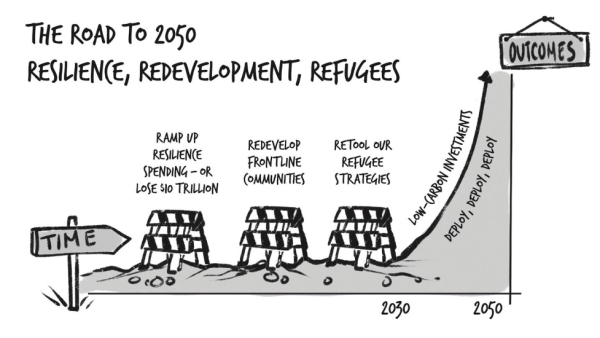

Source: Climate Finance Playbook (2018)

1. Ramp Up Resilience Spending Now—or Lose $10 Trillion Later. Both Democrats and Republicans agree that resilience is a challenge. Representative Alexandria Ocasio-Cortez is right that we should adapt our national infrastructure to climate change. So is Senator Bill Cassidy from Louisiana, who said after Hurricane Ida: “I'm sure hoping that Republicans look around my state, see this damage and say, 'If there’s money for resiliency, money to harden the grid, money to help sewer and water, then maybe this is something we should be for.” Between now and 2050, we could easily lose over $10 trillion if we don’t build resilience into our infrastructure systems. To avoid such a monumental loss, we must do more advance on siting, invest in life-cycle maintenance, and limit damages from storms and fires by investing in underground power lines, to name a few factors. This is $10 trillion we could use for mitigation and R&D in the 2040s and 2050s. But that money may be spent sooner and not be available if we don’t prioritize investing in adaptation this decade. So, do we diligently follow every step in expert slide decks dictating the road to 2030? Or recognize what is already happening with the weather and pivot faster to resilience opportunities as the city of Rotterdam has done?

2. Redevelop Frontline Communities First. We may not be able to save the Marianas Islands and other low-lying communities in the United States because of rising sea levels already “baked” into the global warming equation. But for equity purposes, we should agree to spend significantly more on resilience today because it will save trillions of dollars in the future that we could use to help frontline communities better adapt, mitigate, and innovate. This means helping to protect the most at-risk and underserved communities that repeatedly find themselves in the crosshairs of climate change. Mirroring emerging market risks abroad, the US' underserved urban and rural communities struggle to access complicated federal and state funding grant programs and advance the innovative and low-carbon community infrastructure projects they want to build. For example, 130,000 schools, hospitals, and community colleges want to replicate what the Blue Rancheria Tribe built in Northern California: a community emergency center with micro-grids and wi-fi, providing a place to go after the 2018 wildfires. The key to boosting this community infrastructure pipeline: predevelopment capital that pays for tasks that must be completed before construction begins. Predevelopment funding helps pay for necessary steps in any infrastructure development, like grant proposal writing expertise, economic feasibility studies, site acquisition costs, architectural and engineering work, and permitting. With those costs as a barrier, underserved communities won’t be able to take even the first step in adaptation.

3. Retool Climate Refugee Strategies. The World Bank estimates there are going to be 143 million climate refugees by 2050. When Antonio Guterres, UN high commissioner for refugees, comments, “People think that humanitarians can clean up the mess. It's no longer possible. We have no capacities to pick up the pieces,” it becomes essential to come up with an alternative plan. The US needs to prepare to handle the looming climate refugee crisis by harnessing the US military’s resources. There are different possible approaches to take. Do we shelter and support them in place with enhancements to Amory Lovins’ 2002 idea? Create a new “refugee nation” per Jason Buzi or a climate migration agency per Alexandra Tempus? Launch a real-life Ministry for the Future? Today governments are spending more on border controls than on developing refugee solutions or anticipating future needs. This doesn’t need to be seen as a sunk cost. Parag Khanna has articulately laid out the opportunities of US climate migration this century. Like investing in climate-smart infrastructure, the math on creative prevention investments looks far better than the back-end costs, whether you measure it in lives or dollars.

4. Deploy, Deploy, Deploy. Finally, we must address mitigation strategies. How will we deploy the good tech we have and the new tech we need to drive down industrial emissions, remove carbon, reduce methane emissions, and reform land management? We also need to scale up electrification by building utility-scale wind turbines that are 800 feet tall and 100,000 community-scale micro-grids in the US alone. We need it all, and it will require cross-industry leadership and innovation. Everyone needs to raise their game:

-

Investors and the Capital Markets: Multilateral institutions need to rethink their roles and do more to lower the risk on first-of-their-kind projects. In the United States, serious proposals are under consideration to stand up a climate infrastructure authority that can draw from lessons learned abroad. Moves like this can help to attract additional private capital. But significant investment firms and lenders also need to be more active between trillion-dollar COP commitments by advocating for catalytic capacity involving millions, not trillions. There is also a significant role to play in the private markets by putting more equity risk capital to work in solutions that need to be scaled quickly. Particularly in the US, it means figuring out how to finance the thousands of high-return projects in the $5 million to $100 million range instead of crowding into the easily bankable deals.

-

Deployment-Focused NGOs: We need new champions with the passion of Greta Thunberg to advocate for faster permitting of renewable energy projects and greater alignment among clean energy advocates and species protection groups. For example, instead of blocking needed renewable energy wind turbines, we need further collaboration to develop amicable solutions that protect biodiversity and help produce clean energy. We also need more specialized assistance that helps everyone get in the deployment game. Groups like Moonshot Missions, the Justice 40 Accelerator, and the Rural Community Assistance Partnership are foundational for building community-scale projects and political momentum for the climate. What one might call the infrastructure for infrastructure needs more love.

-

Climate-Focused CEOs: Many companies (and the world’s biggest polluters) claim an easy out: They need cleaner technologies to reduce their emission footprint, but those technologies are not yet at a meaningful scale for their business. CEOs of companies big and small must prioritize partnerships and early-stage investments to help move desperately needed technologies out of the science lab and into commercial facilities. Capital for these technologies is heavily VC-funded today. Still, with $35.5 trillion in sustainable investment assets, innovative financing mechanisms can match capital with investment opportunities that stand to have the most significant impact. The Milken Institute spent months interviewing and convened corporates and investors to understand what is needed to move the needle by matching technologies that need capital with financing models that are feasible for institutional investors.

-

Utilities: America’s electric utilities are in a tough spot. Many have outright failed to prepare properly for known risks. On the other hand, raising rates to make critical grid-hardening investments has been nearly impossible for the last 15–20 years. Without electricity rates that reflect the true value of the grid, things will only fall further behind. Hopefully, smart new provisions in the pending federal infrastructure package will finally give electric utilities the right mix of mandates and financial incentives to do resilience right.

Final Mantra: Big, Bold, and Doable

Big and bold commitments garner headlines, but long-term success depends on smart deployment. Pledges are meaningless without a path towards implementation. To stay under a 1.5 degrees Celsius increase in temperature, we need big, bold, and doable strategies that acknowledge reality. We can no longer afford to overvalue moral urgency and undercount the costs of delay by over-reaching and under-delivering. We are heading towards 10 billion people on this planet who need water and food while the soil is eroding at record rates, according to Jeremy Grantham. The exciting cross-sectoral announcements and initiatives made recently on the world stage shouldn’t be minimized. But we now need clear next steps to ensure the pledges become a reality.

Thanks in advance to the good folks working on these, including those working to strengthen global efforts to deploy resilience deployment strategies through efforts like the Coalition for Climate Resilient Infrastructure. Because we need it all.